A Property Tax Could Best Be Described as

For the purposes of this guide property tax is restricted to annual taxes and excludes one-off taxes on transfers on realised. A companys effective tax rate can best be described as.

The tax on gasoline is an.

. It may be described as government without taxation F. JLLs B2C business model could best be described as a platform model An _____ is designed to capture the events leading up to a product or service launch trying to understand the thinking behind decisions made. Collected and currently matched with expenses.

The adjusting entry at the end of the Year 1 is. The answer is epimers. The companys financial statement income tax provision divided by taxable income.

A train that crashed. Financial debts and obligations that you owe. The companys cash taxes paid divided by taxable income.

The companys cash taxes paid divided by net income from continuing operations. The Dust Bowl c. 3 Get Other questions on the subject.

Then the best way is property tax appeal. Townships run north and south and range lines run east and west. Government corporations are best described as.

A businesses that have gone bankrupt and have been taken over by the government. A property tax or millage tax is levied on the value of property an ad valorem tax that the owner is required to pay. Prepaid property tax 3 property tax expense 3 c.

Choice A is the best answer. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax. Which best describes Income tax.

C business enterprises that the government has seized because of failure to pay taxes. Therefore the narrator of the passage can best be described as one of. Monetary items of value that you own.

Regressive taxes have a greater impact on lower-income individuals than the wealthy. According to the third paragraph one cause of the Great Depression was a. It is a direct tax.

Add your answer and earn points. Two sugars that differ only in the configuration around one carbon atom are called epimers. Social Studies 22062019 1000 faithcalhoun.

For example each township is six square miles or 23040 acres and contains 36 square sections which are each intended to be one square mile or 640 acres. Proportional tax also referred to as a flat tax affects low- middle- and high-income earners relatively. It is usually but not always a local tax.

Ergonomics can be best defined as. Which conflict is often referred to as the first televised war. What type of property describes the formation of a new substance.

An unearned revenue can best be described as an amount a. The two monosaccharides shown below could BEST be described as. B agencies that privately see to the personal needs of high-level bureaucrats.

A companys effective tax rate can best be described as. Arent the C2 and C3 both differ in the configuration. An ocean wave that swallowed a boat.

Total revenue from direct and indirect taxes given as share of GDP in 2017. The largest source of tax revenue for the federal government is. Aspect of taxation which could be delegated.

The tax base may be the land only the land and buildings or various permutations of these factors. Function that could be exercised by the executive branch. Multiple Choice The companys cash taxes paid divided by taxable income.

The companys financial statement income tax provision divided by taxable income. The companys cash taxes paid divided by net income from continuing operations. Reliance on credit d.

A property tax could best be described as a 1 See answer Advertisement Advertisement blah4849 is waiting for your help. A fire that continued to grow. FUTA taxes are 06 and SUTA taxes are 54 of the first 7000 paid to each employee.

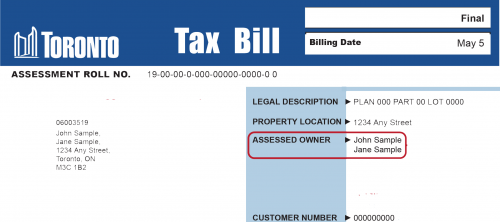

All of the following are legislative aspect of taxation except. According to the 2nd paragraph the American economy could best be compared to a. Paid to state or local governments based on the assessed value of property.

How a 500-page book of political economy could become a best seller among carpenters and bricklayers and typesetters. Georgia Property Tax Rates. Collected but not currently matched with expenses.

Selection of the object or subject of tax b. But the definition of epimer is. Assets that depreciate over time.

Throughout the passage the narrator refers to Miss Spiveys 1938 class as we and us and describes interactions between Miss Spivey and her students as a firsthand observer indicating that the narrator was a member of this 1938 class. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. What happens to a.

Financial debts and obligations that you owe. He described the property tax in feudal terms saying it dates back to the dark ages or the middle ages when the lords of the manor had to pay taxes to the Kings and the Queens otherwise they. These vary by county.

You can even hire a Property tax lawyer who can help you to reduce your property taxes. The companys financial statement income tax provision. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

The legal description pinpoints the location of a given property within its particular township range and section. Which best describes Property tax. 31 Property tax is an annual tax on real property.

Fixing the tax rate to be imposed is best described as a an. Liabilities are best described as a. Prepaid property tax 9 property tax expense 9 b.

It is most commonly founded on the concept of market value. As a citizen of a country you must pay tax and property tax is one of them when you owe property you must pay. A property tax could BEST be described as a.

A bubble that busted. Paid by businesses or individuals on money they make. Last month an Idaho lawmaker called the property tax inherently evil and suggested the state repeal it and replace the foregone revenue with a higher sales tax.

A tax you get when you owe property.

No comments for "A Property Tax Could Best Be Described as"

Post a Comment